Table of contents

-

Creation history

-

Technologies and products

2.1. Rootstock

2.2. RIF

2.3 Roadmap for 2024-2025

-

Ecosystem and development

-

Tokenomics

-

Team

-

Investors and finance

-

Activities

-

Results

1. Creation History

The RSK project is one of the pioneering initiatives on the Bitcoin network, launched in 2015. Originating from the QixCoin project, which first introduced the concept of payment for execution, now known as "gas," RSK was developed by the same team. The project aimed to create functionality comparable to Ethereum based on previous advancements. In the summer of 2022, the project rebranded as Rootstock, a sidechain on the Bitcoin network.

Alongside Rootstock, the team developed various products based on RSK, including dApps such as DEX, Wallet, Domain Service, and more. These dApps were built on general-purpose protocols encompassing payments, storage, computing, communications, and gateways/bridges. The goal was to establish a comprehensive RIF ecosystem (RSK Infrastructure Framework), unified under the RIF OS technology.

Although the unified RIF OS ecosystem was only partially realized, the company's current focus is on implementing Layer-2 solutions on Bitcoin via Rootstock. RIF Labs has developed several protocols and dApps, refocusing itself as a development team for Rootstock. The subsequent discussion will delve into Rootstock technology (RSK) and RIF products as key technological innovations.

2. Technologies and products

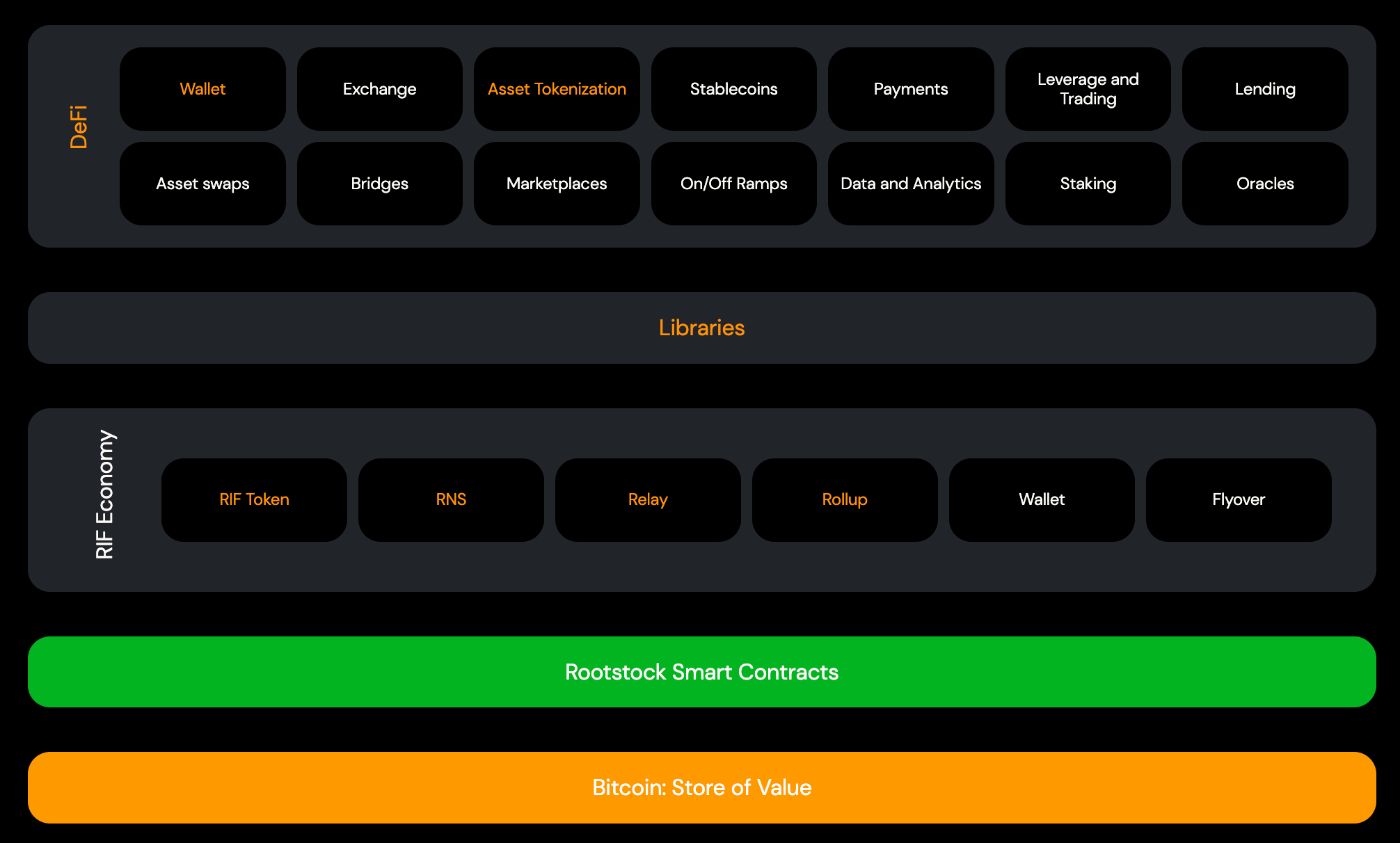

RIF OS includes a large set of different services at each level of interaction:

2.1 Rootstock

Powpeg

The core technology of the Rootstock network is Powpeg, a two-way peg protocol designed to connect different decentralized networks, specifically the Ethereum Virtual Machine (EVM) and Bitcoin. Rootstock is fully EVM-compatible, meaning it functions similarly to the Ethereum network.

The Ethereum and Bitcoin networks have fundamentally different execution and block formats, making direct interaction between them impossible. For two different networks to communicate, their states must be readable at any point in time, necessitating the transfer of cross-chain messages using smart contracts. Since the Bitcoin network lacks native cross-chain messaging functionality, implementing classic cross-chain interaction is impossible. Moreover, cross-chain messaging was largely unexplored at the project's inception.

Bitcoin also faced technical limitations, many of which persist today. Consequently, the project team utilized the only feasible technology available on the Bitcoin network at the time: multisignature (multisig) signatures. A multisig wallet was created on the blockchain, with multiple addresses acting as signers. Transactions could be sent and confirmed only by majority vote, decentralizing trust and eliminating a single point of failure.

Building on the multisig wallet, the team developed add-ons for automatic transactions. However, this approach had a significant drawback: a lack of true decentralization. The signatories of the wallet were individual people and organizations. If they colluded, they could potentially attack the network and cause irreparable harm. This structure is known as a federation, and the Layer-2 network itself is termed federated, as network decisions are based on the consensus of selected representatives rather than the entire network.

The largest wrapped Bitcoin, WBTC, operates according to a similar model. It has multi-sig wallets on the Bitcoin and Ethereum networks and 12 signatory companies known in the community. Well-known companies were specifically chosen, since there is one component here - a large company will not want to compromise its reputation in exchange for malicious actions against WBTC. The union of such large companies significantly strengthens this factor, since it is unlikely that 7 such companies at once (the majority required for signing) will be ready to destroy their reputation. In fact, this is the only guarantee that WBTC will be serviced correctly. But this is categorically opposed to the major concept of blockchain, decentralization and trustless.

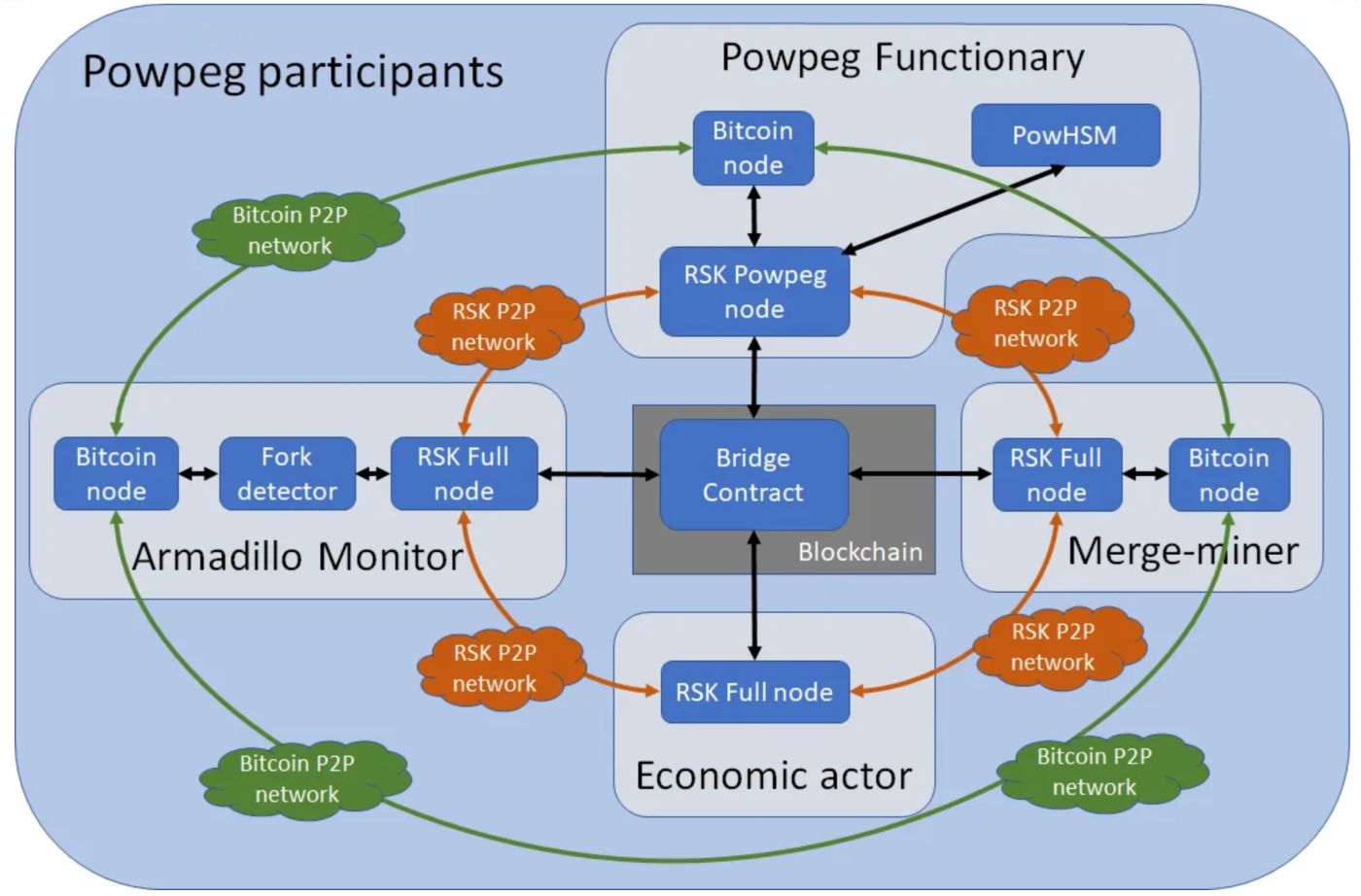

Signatories to the Rootstock multisig protocol are called "Functionaries." They connect specialized equipment known as PowHSM, which interfaces with a specific type of Rootstock node called Powpeg nodes. These nodes provide Functionaries with comprehensive information about the state of the Rootstock network and its transactions. PowHSM generates a unique private key for signing the multisig protocol, necessitating a secure and stable network connection to ensure the device's confidence in network integrity.

Functionaries also need to monitor the Bitcoin network to verify transactions. Instead of deploying resource-intensive nodes for this purpose, the team utilized SPV (Simplified Payment Verification) technology. This approach allows transactions to be validated by checking the header of each Bitcoin block, eliminating the need for full nodes.

Functionaries do not participate in network consensus or block production. Their primary role is to facilitate correct cross-chain BTC transfers between the Bitcoin and Rootstock networks. But the question appears: why develop such complex technology for a wrapped asset? The reason is that this wrapped asset, RBTC, serves as gas for the Rootstock network, necessitating the highest possible level of trust. If the RBTC-BTC connection is compromised, the entire network's functionality could be stop.

The final process for transferring BTC to Rootstock is as follows:

1. The user initiates a transaction to transfer BTC to RBTC

- BTC on the Bitcoin network is sent to a multisig address controlled by Powpeg signers

- Powpeg receives a signal that BTC has arrived in the wallet

- Powpeg creates an equal amount of RBTC tokens

- RBTC are sent to the Rootstock network address entered by the user

Connecting to Powpeg requires a specialized device called PowHSM, which presents a potential critical point of failure. To mitigate this risk, additional procedures have been developed to verify the correct installation of PowHSM. A dedicated audit team currently handles this verification process, introducing a risk of centralization. However, the team plans to eliminate manual labor and fully automate this process in the near future.

Additionally, the process of completing a BTC transaction between networks is notably lengthy due to the 10-minute duration of a Bitcoin block. To protect the "wrapper" from malicious actions, transaction finality requires a significant amount of time:

- Depositing BTC into the Rootstock network takes 100 blocks (approximately 17 hours).

- Withdrawing RBTC to the Bitcoin network takes 200 blocks (approximately 33 hours).

It's important to note that while withdrawals from Optimistic Rollups can take 7 to 14 days, deposits are processed almost instantly.

Merged Mining

Consensus in the Rootstock network is based on classic Proof-of-Work (PoW), involving miners in transaction processing and block creation. Rootstock leverages the same miners who mine Bitcoin blocks, thereby enhancing its security without developing an entirely new mining infrastructure. However, this approach provides only a fraction of Bitcoin's security and leaves Rootstock vulnerable to attacks and state rollbacks, which can be executed relatively cheaply.

To address this, the team implemented Merged Mining technology, allowing simultaneous mining of multiple coins from different networks, specifically Bitcoin and Rootstock. In the Rootstock network, there is no block reward; instead, miners receive a share of the network's transaction fees.

The technology is straightforward: miners connect their equipment to both networks simultaneously. The header of a Rootstock block is included in the Bitcoin block. Before inclusion, the difficulty levels of both networks are compared, and if they differ, the block is not added to the Bitcoin network. This algorithm was first introduced on the Namecoin network.

A key challenge is that not all miners support Merged Mining for various reasons. Consequently, the secondary network only benefits from a portion of Bitcoin's security. Blocks from the secondary network will not be published in Bitcoin unless the miner supports Merged Mining, creating security gaps.

However, Rootstock benefits significantly from this arrangement. Any attempt to roll back the Rootstock network state would require a rollback of the Bitcoin network as well. Due to gaps in Rootstock block mentions within the Bitcoin network, such rollbacks would be challenging and costly. The deeper the rollback, the more difficult and expensive it becomes.

On the Rootstock network, blocks are produced approximately every 30 seconds. Transaction fees, or gas, are distributed to three parties:

- Miners: 79%

- Multisig protocol signatories: 1%

- Rootstock team: 20%

Payments are managed via the REMASC (Reward Manager Smart Contract) smart contract and are made every block.

The final architecture of the Rootstock network (distinct from RIF OS) is as follows:

2.2. RIF

As already mentioned, RIF is a set of various services that create a full-fledged ecosystem on top of Rootstock:

- RIF Relay

- rLogin

- RNS

- RIF Rollup

- RIF Wallet

Let's tell you a little more about them.

RIF Relay

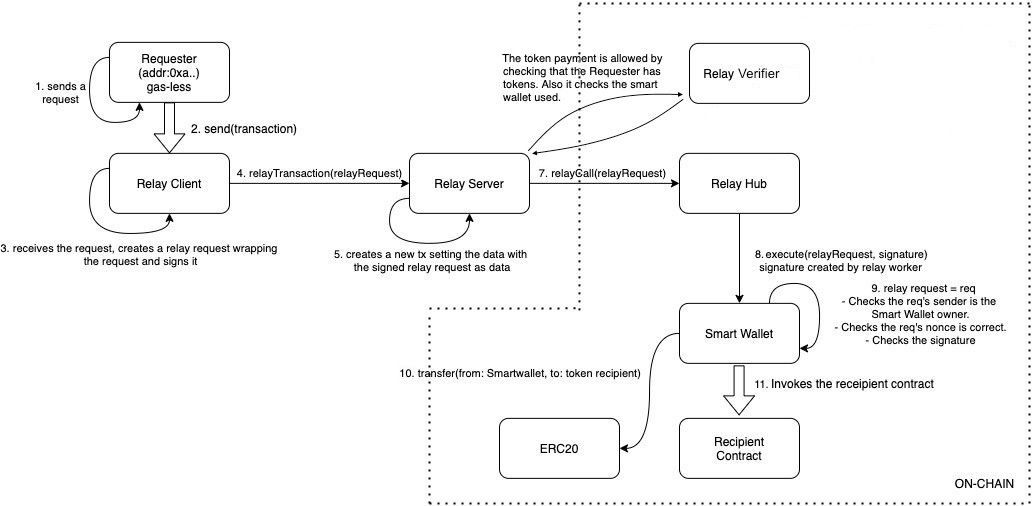

RIF Relay is a system that allows users to pay for network gas using any token, not just RBTC. Essentially, it is a separate, fully-fledged network with its own technical architecture, deployed on top of Rootstock. This system provides end users the flexibility to pay in various tokens (from a pre-approved list), simplifying their interaction with the network and enabling what are effectively gasless transactions. However, the underlying process is much more complex:

- User creates a gasless transaction request

- The request is sent to the Relay client

- It wraps this request in a Relay Request and signs it

- The wrapped request is then sent to the Relay Server (off-chain component)

- It creates a transaction and sends it to the Relay Worker (returns back to the on-chain component)

- Relay Worker verifies the transaction and data, and then signs it

- The signed transaction is sent to Relay Hub, which checks 2 parameters from Relay Manager:

- availability of RIF tokens in staking through Staking Manager

- availability of RBTC for gas payments

- If both parameters are satisfied, then Relay Hub sends an instruction to Smart Wallet to execute the transaction.

- Smart Wallet verifies the user's signature.

- After this, Smart Wallet carries out the transaction using RBTC held by Relay Manager.

The RIF Relay system involves several participants, categorized into three main groups:

- Relay Hub: This is the core component responsible for executing transactions.

- Relayer Client: An off-chain client running as a separate server via HTTP.

- Relayer Worker: An on-chain client that directly sends transactions, pays gas in RBTC, and receives tokens used by the user to cover gas fees.

- Relayer Manager: A staking account responsible for registering the Relayer Client and Relayer Worker within the Relay Hub.

- Staking Manager: Monitors all Relay Hub accounts and their staked assets.

- Smart Wallet: Functions as an account that can also act as a smart contract, similar to Ethereum's ERC-4337.

RIF Relay is an analogue of Account Abstraction technology, utilizing an Intent-Based approach. This approach creates a separate space/mempool where individual representatives (Solvers) compete for the right to execute transactions. This structure enhances flexibility and efficiency, simplifying the user experience while maintaining the robust functionality and security of the Rootstock network.

rLogin

The technical software allows application developers to connect multiple wallets simultaneously, eliminating the need for separate integrations for each wallet. To implement this project, the team created several related solutions:

-

Decentralized ID (DID): A decentralized authentication protocol that collects and encrypts user information, preventing access by third parties or intermediaries. This protocol serves as a login method, verifying whether the user controls the account when accessing the application.

-

RIF Data Vault: A user data store to which only the user has access. Data is stored encrypted on IPFS and can only be accessed with the user's permission.

Through these solutions, the team has implemented a robust approach to user security when connecting third-party wallets. This required the creation of separate solutions for DID and decentralized data storage, ensuring high levels of security and privacy for users.

RNS

RNS, or RIF Name Service, is a standard protocol that converts user addresses into human-readable formats, enhancing and securing interactions with other network participants. This protocol operates on the Rootstock network.

The protocol consists of two key components:

- RNS Registry: This is essentially a database that links addresses to domain names. Protocols access this registry when interacting with addresses in a domain format.

- RNS Resolvers: These are contracts that retrieve data for requesters. When a request is received, resolvers contact the RNS Registry and provide the necessary information to the client in a completely decentralized manner.

This structure ensures improved usability and security for users within the Rootstock network.

RIF Rollup

RIF Rollup is a zkRollup implementation built on the Rootstock network, utilizing traditional methods for processing transactions in a zk-SNARK format. This approach involves encrypting all transactions, aggregating them into batches, and submitting them to the parent blockchain, Rootstock.

Powered by ZK Proofs, similar to the technology of zkSync, RIF Rollup significantly boosts throughput and reduces transaction costs. Initially designed for payment processing, this technology has potential applications across various domains.

RIF Rollup is derived from zkSync Lite (V1), originally developed by the Matter Labs team. The RIF team has deployed this network in a test environment and is currently exploring its integration into applications, particularly focusing on crypto wallets.

RIF Wallet

RIF Wallet is a classic non-custodial wallet that is focused on DeFi protocols and is built on Account Abstraction technology. It includes other RIF OS services such as Relay, RNS, rLogin. This means that completely gasless transactions can be carried out between human-readable addresses.

2.3 Roadmap for 2024-2025

The team closely monitors advancements in the Bitcoin ecosystem, particularly the BitVM technology, which serves as the foundation for their upcoming initiative, BitVMX. This new technology aims to establish fully decentralized bridges between the Bitcoin network and its sidechains.

Currently, such connections are managed through federated networks, which pose risks of centralization. BitVMX will introduce smart contracts capable of verifying zk-proofs using an optimistic approach. This innovation has the potential to revolutionize native bridges on Bitcoin, impacting not only the Powpeg algorithm used by Rootstock but also bridges across other Layer-2 networks and sidechains.

Another goal is to accelerate block finality by reducing block creation time from 30 to 5 seconds. Additionally, the team plans to implement a minimum gas threshold and stabilize gas payments using stablecoins. These changes will enhance consensus mechanisms, including the introduction of parallel transaction execution, aiming to significantly boost the scalability and throughput of the Rootstock network.

Furthermore, the team is focused on developing an RBTC SuperApp, consolidating their recent advancements in DeFi tools on the Rootstock network. This SuperApp will support Ordinals/Runes/BRC-20 formats and facilitate cross-chain translations, among other technologies. It is envisioned as a unified Rootstock wallet or part of the RIF ecosystem, integrating various components of their ecosystem.

Considering the substantial progress the team has made in Bitcoin technologies since 2015, the prospects for implementing these ambitious projects appear promising.

3. Ecosystem and development

Rootstock is an EVM network on top of the Bitcoin network, designed as a sidechain. You can create various dApps on it, no different from other EVM networks and rollups. In fact, this means that any company or developer can easily transfer a project from the EVM network to Rootstock. This makes it easier to form an ecosystem and attract developers.

Currently, the volume of liquidity in the network’s DeFi protocols is about $200 million and is at an all-time high. There is a high probability that this value may increase several times more. Thus, since the beginning of 2023, TVL has grown 4 times or 400%. This is a significant indicator considering that the crypto industry was in a bear market for most of this time.

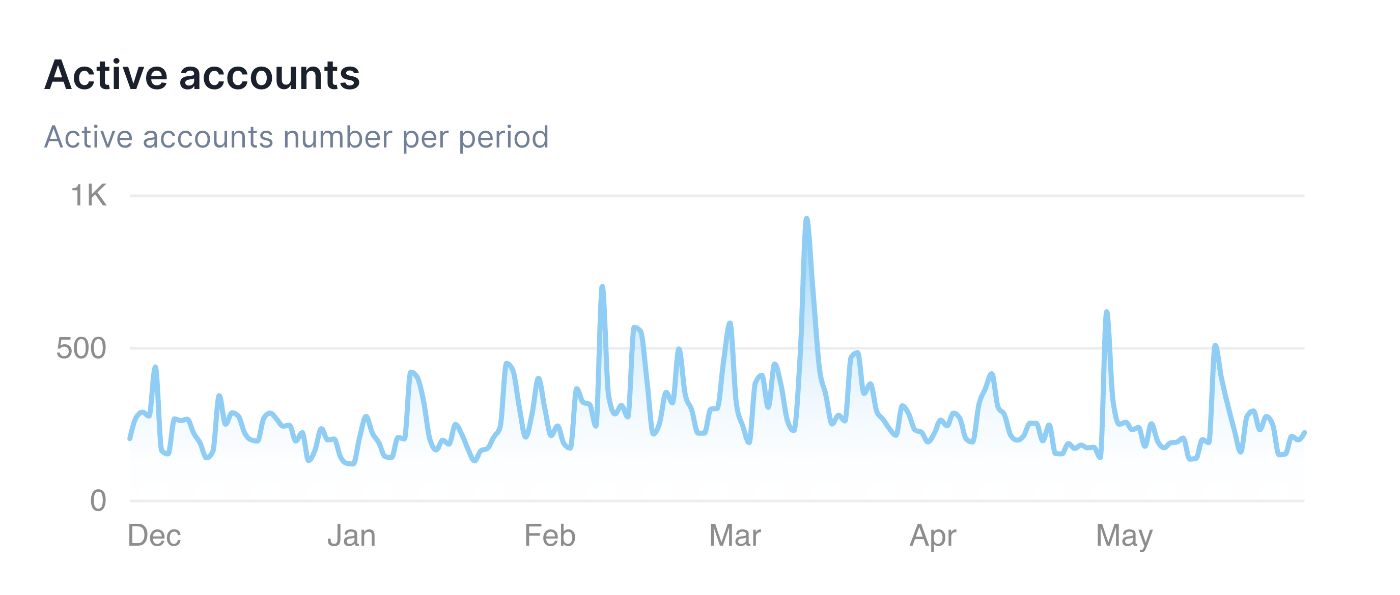

At the same time, the situation with network activity is in a weak state:

On average, only 300 addresses use the network every day, which is an extremely low number. For comparison, about 5,000 addresses use the Stacks network every day, which is also a low number in comparison EVM netowrks.

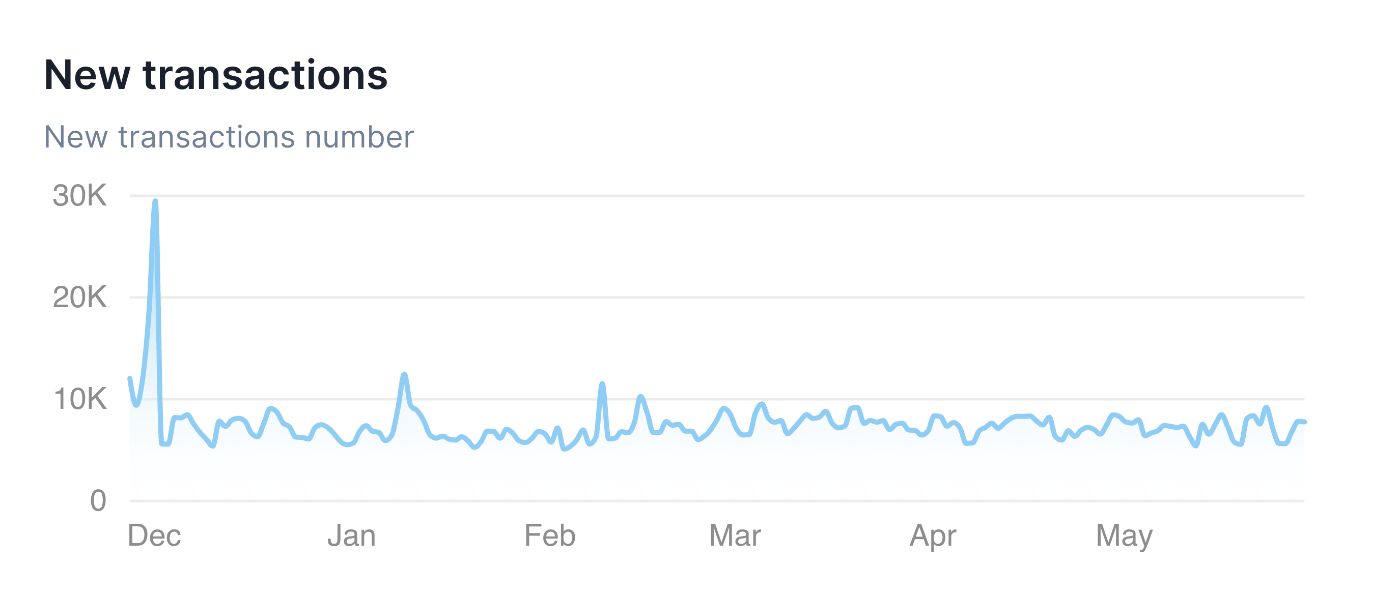

At the same time, the volume of transactions is about 7 thousand per day:

However, it is worth remembering here that this is a PoW network, which means miners’ transactions are also taken into account. Such an even graph indicates that almost all transactions are used only to reward miners. The low number of daily active accounts only confirms this conclusion.

Based on this, the question arises, why is TVL growing so much? To do this, I superimposed the BTC price chart on the TVL chart of the Rootstock network:

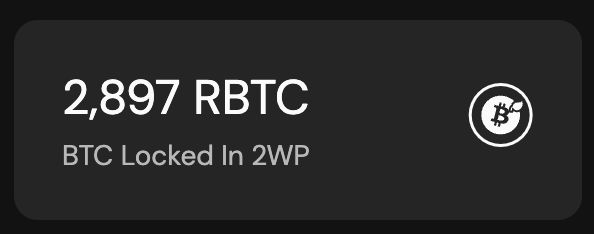

There is a very strong correlation with the price of Bitcoin. This means that the growth of TVL is primarily associated not with user activity, but with the growth of the BTC rate. Let me remind you that the main asset of the network is RBTC, which is linked to BTC in a 1:1 ratio. Therefore, you can see how many RBTC are blocked in the Powpeg bridge:

Currently, with Bitcoin priced at $56,000 per BTC, the total value locked (TVL) in Rootstock is approximately $150 million. This effectively means that RBTC constitutes virtually all of the TVL, with user activity having minimal impact on the network.

Another critical aspect of the network is its security, primarily driven by miner participation. The combined hashrate of miners on Rootstock totals 280 Eh/s, whereas the Bitcoin network boasts a total hashrate of 645 Eh/s. This indicates that Rootstock's network security stands at approximately 43% relative to Bitcoin. Notably, a significant portion of Rootstock's mining power is concentrated among 2-3 major pools, such as Antpool, F2pool, and potentially Luxor, which collectively control around 80% of the network's capacity. However, details about other participating miners and pools remain undisclosed.

The Powpeg protocol, integral to Rootstock's operation, operates through a federated network comprising 9 participants:

- Rootstock Labs: Development team behind the network.

- Luxor: US-based BTC mining pool catering to large clients.

- Sovryn: Leading DeFi protocol on Rootstock with multiple DeFi products.

- My Container: Professional staking provider since 2018.

- XAPO: Custodial crypto wallet acquired by Coinbase.

- P Network: Cross-chain protocol operational since 2019.

- Constata: Education-focused tokenization project.

- Collider: Venture fund specializing in cryptocurrencies.

- Block Venture: Group of researchers focused on blockchain and Bitcoin.

The diversity of participants' activities is a crucial element in any federated network to mitigate potential collusion risks.

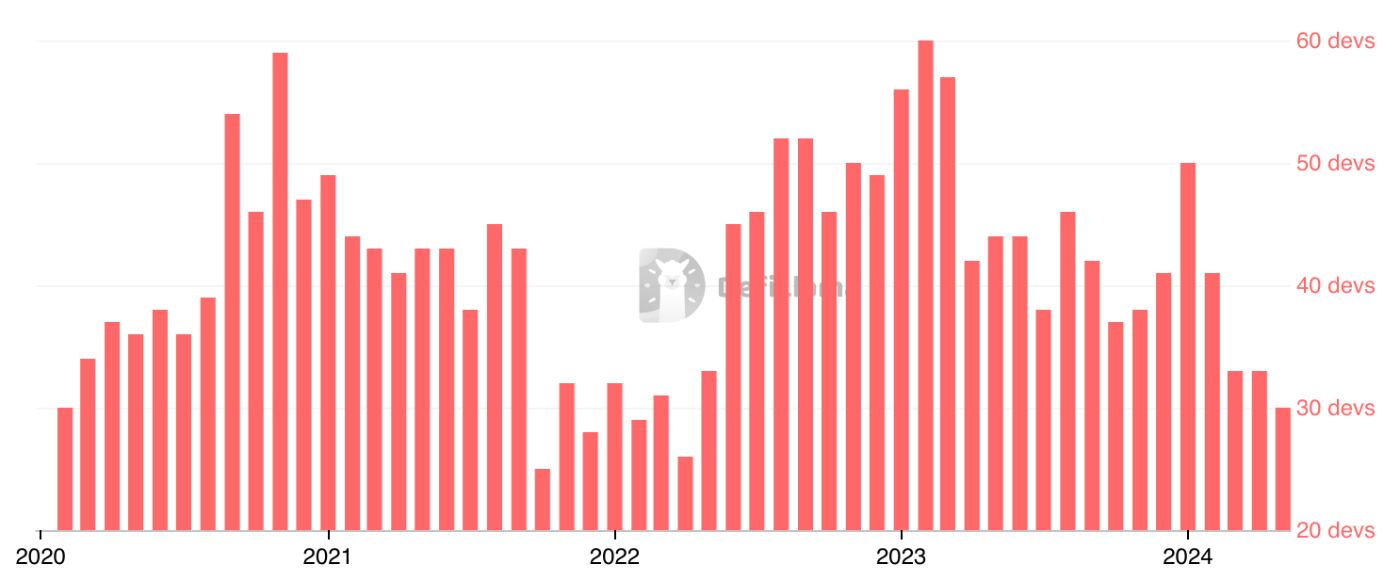

The number of developers in the network is relatively stable and ranges from 30 to 60 people. However, starting in 2023, this figure has dropped by 2 times, which indicates a lack of desire among developers to use this network. This is a rather negative factor.

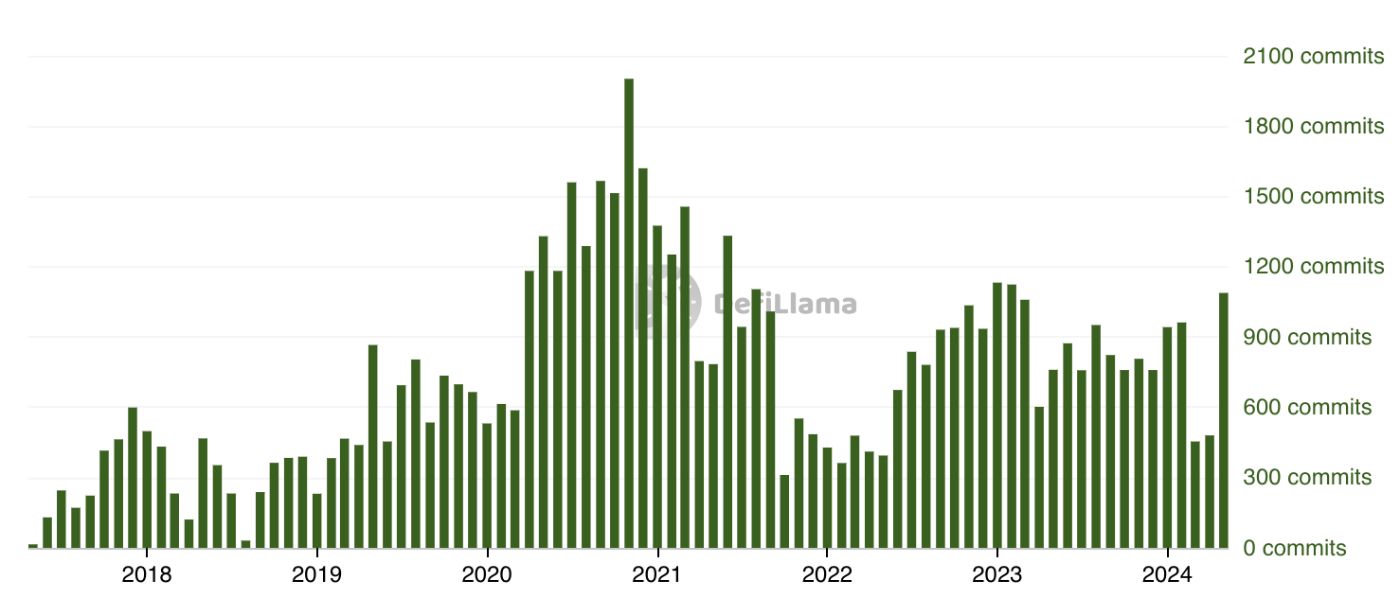

However, if you look at the number of commits, the situation is slightly different:

Starting in 2023, this metric has increased by an average of 3 times. What could this situation mean?

-

The network itself may be interesting for developers, as we see commits growing little by little.

-

However, due to low activity, developers quickly leave and give up their projects due to lack of real use.

In fact, this means that new teams come but do not stay for long due to some factors, most likely due to the low number of users. That is, as a technology, the project may be of interest to developers and projects, but there are too few end users. This is also proven by the fact that the Rootstock ecosystem currently has over 100 projects:

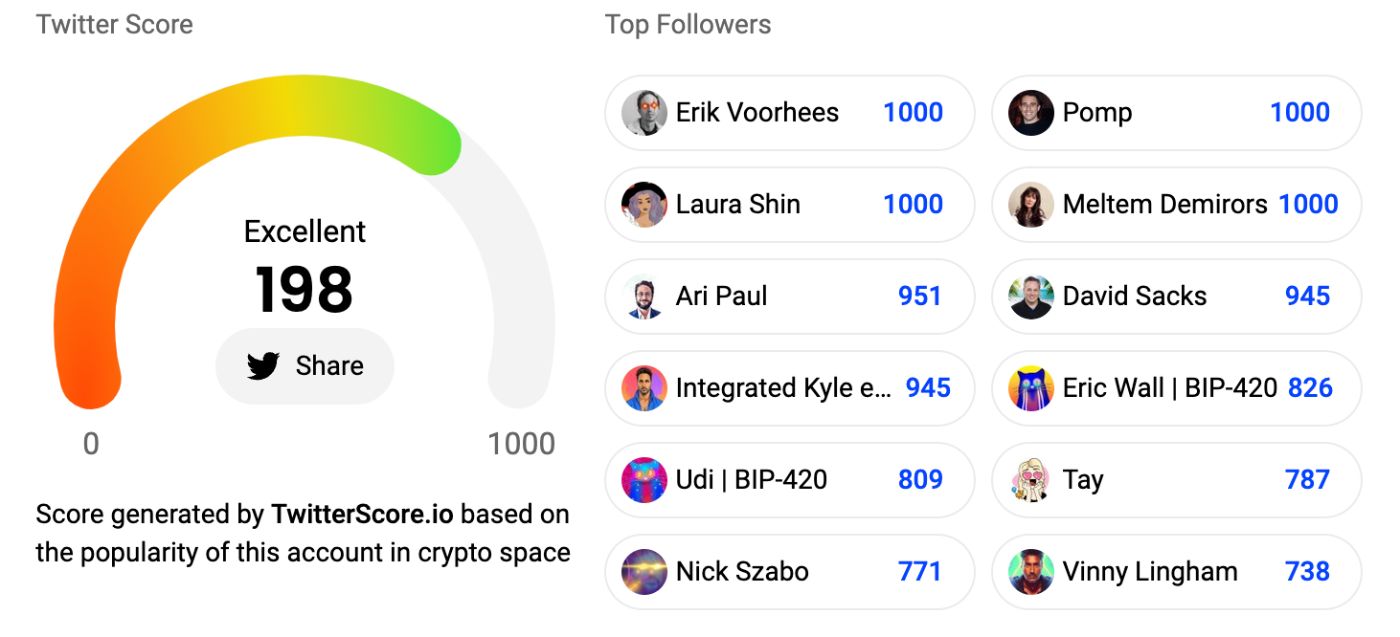

Now let's take a look at the project's social networks:

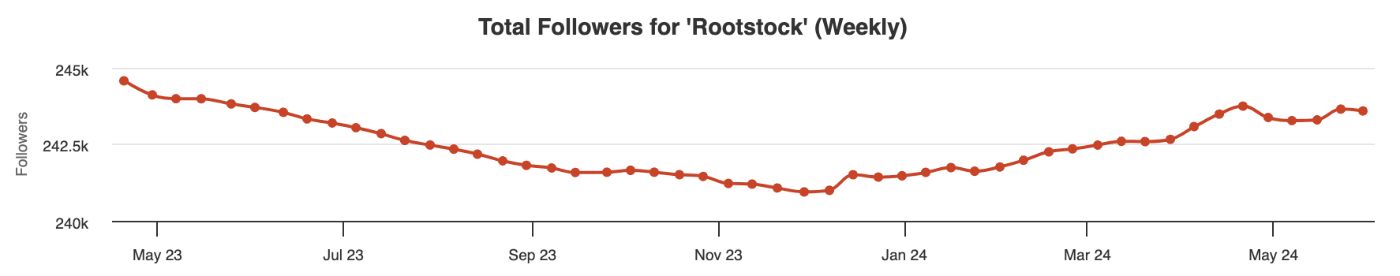

It is especially interesting in the context of this situation to look at the growth dynamics of Twitter:

It is clearly visible that in 2023 the number of subscribers to the project decreased. And only six months ago, in December 2023, this dynamic was broken and the project moved on to growth, albeit a small one. This is primarily due to the fact that during this period of time the strong BTC L2 narrative began to appear, and Rootstock is one of the largest and oldest players in this space along with Stacks.

Simultaneously, the project enjoys a strong presence on Twitter, attracting subscriptions from prominent figures in the crypto industry and numerous Tier-1 funds. This sustained high rating over an extended period indicates significant interest and close monitoring from these influential stakeholders.

Upon examining the project's development trajectory, it becomes evident that their primary challenge at the current stage is low user engagement. Despite consistent developer interest and project launches, Rootstock remains underutilized by a small user base. Many teams and influential individuals recognize the project as a key player in the Bitcoin Layer-2 sector.

Expanding the user base could significantly enhance the project's visibility and reputation within the broader community. This step has the potential to elevate its status and garner widespread recognition.

4. Tokenomics

The token sale for the RIF token occurred in November 2018, with a total issuance of 1 billion tokens allocated as follows:

-

40% for sale during a closed ICO

-

40% for the RIF Labs team, with monthly vesting over five years, including 2.1% for incentive programs for early adopters

-

20% for the RSK Labs team, with monthly vesting over four years

The closed ICO required participants to complete full KYC/AML procedures and gain team approval, making it inaccessible to the general public. This sale raised a maximum of 22,000 BTC, equivalent to $83.6 million at the time, with 1 BTC priced around $3,800.

Although the exact price per RIF token during the ICO was not publicly disclosed, it can be estimated as follows:

-

0.000055 BTC per RIF (current value: 0.00000236 BTC, a decrease of 95.7%)

-

$0.209 per RIF (current value: $0.167, a decrease of 20%)

The historical maximum price for the RIF token was $0.5, providing ICO participants with a maximum return of 2.5x. The initial token distribution appeared skewed, with 60% allocated to the team and 40% to ICO participants. However, the significant pressure on the token's value ended in the fall of 2023, with all tokens now fully distributed and their price determined solely by market dynamics. Currently, there are just over 18,000 RIF token holders, which is below the market average.

The RIF token's utility is primarily within the RIF OS ecosystem, where it can be used for services such as staking or gas payments. However, the actual usage of these services remains minimal, resulting in limited practical use of the RIF token within the ecosystem.

5. Team

The situation with the team is not entirely standard. Initially there were 2 teams:

- RSK Labs is the team that was entirely involved in the Rootstock smart contract platform.

- RIF Labs is a team that developed custom services for the Rootstock network.

In the fall of 2018, RIF Labs announced that it was acquiring RSK Labs and all its developments. The combined company was named IOV Labs and then Rootstock Labs. Key people of the company:

Diego Gutierrez Zaldivar - ex-CEO and Co-Founder of RIF Labs. In May 2023, he stepped down from his management role but remains on the board of directors. He managed the company for seven years and is a well-known early Bitcoin advocate, having founded and invested in several Bitcoin-related companies in the 2010s. With extensive experience in managing and creating startups, he is often regarded as a serial entrepreneur. He has been a prominent promoter of Bitcoin in Argentina.

Daniel Fogg - CEO since May 2023, previously held senior positions within the company for three years. Before joining Rootstock, he led international projects across Asia, the Middle East, and the UK.

Ruben Altman - COO and Co-Founder, currently focused on developing the Rootstock platform. He has over 20 years of experience in creating various technology startups in Argentina and Europe.

Adrian Eidelman - CTO and Co-Founder, serving as the technical director responsible for the company's technological advancements. Before joining the company, he spent nearly 20 years in software development.

All the founders of the team are from Argentina, and its first CEO is one of the key people in the promotion of Bitcoin and cryptocurrencies throughout the country. Currently, the project team has about 150 people, most of whom are also from Argentina and South America.

At the same time, the team is actively expanding - 12 vacancies are open in the company. I especially note that most of them are related to marketing and development of the company in the international market. This indicates that the company plans to begin active work to attract customers and users to the Rootstock network and RIF services.

6. Investors and Finance

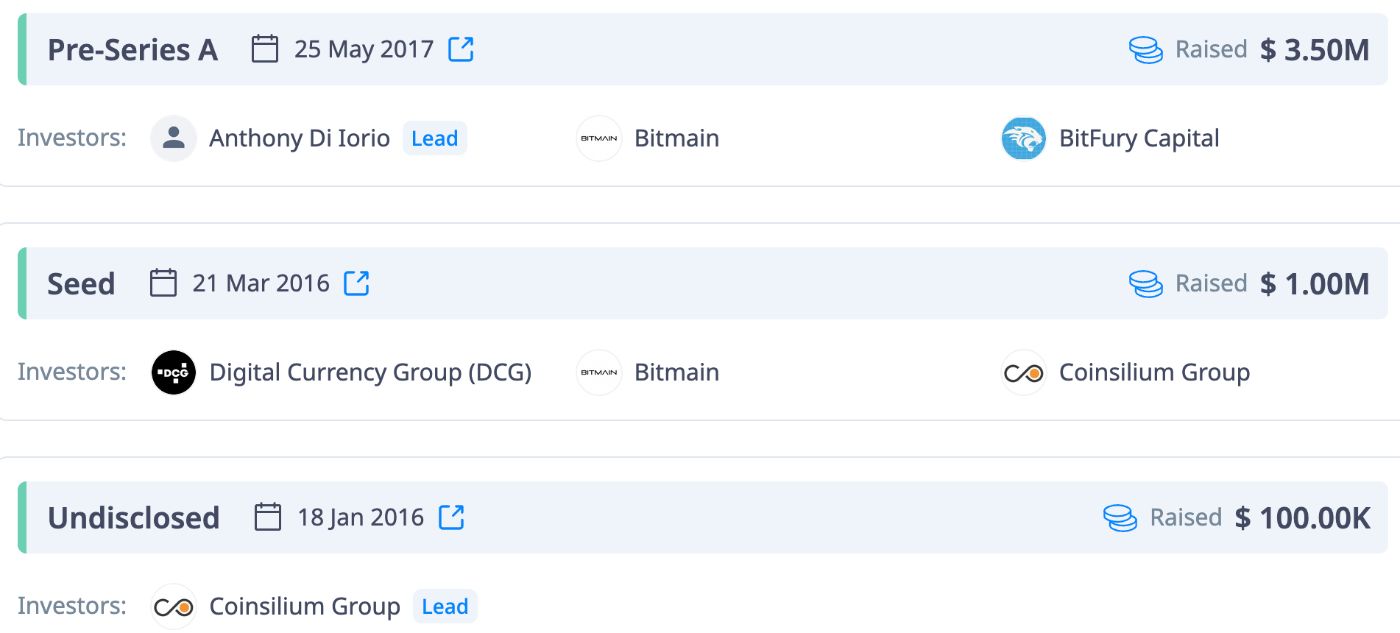

RSK Labs secured its first round of funding in January 2016, raising $350,000 at a valuation of $5 million. The primary investor was the Coinsilium Group fund, which acquired 42% of this round, partly through its subsidiary, Seedcoin.

In March 2016, just a few months later, the project secured an additional $1 million in investment. This round saw reinvestment from Coinsilium Group, alongside Tier-1 investor Digital Currency Group (DCG) and the leading mining equipment manufacturer Bitmain. Notably, DCG also invested in another project, Stacks, indicating their strategic focus on the development of Bitcoin sidechains.

The final funding round for RSK Labs was announced a year later, in March 2017. During this round, the team raised $3.5 million, with significant contributions from well-known mining companies such as Bitmain and Bitfury.

All investments were raised in the form of BTC. At the beginning of 2016, BTC was priced around $400, and by the end of 2017, it surged to $20,000. This significant appreciation allowed the team to multiply their investment purely due to BTC's growth.

In 2018, RSK Labs was acquired by RIF Labs. As part of this transaction, the RSK Labs team and its investors received RIF tokens proportional to their ownership in the company. RIF Labs conducted a closed token sale, raising 22,000 BTC, equivalent to $83.6 million at that time. This amount was one of the largest ICO raises, comparable to Tezos or Bancor. Given the subsequent increase in BTC value, their actual value increased tenfold within just two years.

At current exchange rates, 22,000 BTC is worth a staggering $1.5 billion. Even if the team spent 30% of the investment over five years, their remaining assets would still exceed $1 billion. Although the team does not have a transparent spending policy, this speculation suggests significant financial stability. Such a round is considered large even by recent standards, comparable to Tier-1 projects like Arbitrum, Optimism, and Aptos.

From a financial perspective, the team appears robust. Potential project costs, in the worst case, would not exceed $20 million. Thus, they have a substantial financial cushion and leverage to increase their marketing activities.

7. Activities

In recent months, the team has ramped up its engagement with the community, launching several programs to foster involvement:

-

Grants: The project has allocated $2.5 million to fund various projects and teams. Anyone can submit an idea, and upon approval and implementation, they receive a monetary reward.

-

Bug Bounty Program: Participants can help identify security and critical errors within the project and earn rewards as "white hat hackers."

-

Ambassador Program: This initiative aims to increase the project's visibility by attracting individuals and teams interested in its growth. Participants can moderate communities, discuss the technology, assist in organizing events, and engage in various marketing activities. To join, one must submit an application.

-

Bitcoin Writing Contest: This contest encourages writing articles and research about Bitcoin, its ecosystem, and Rootstock, posted on Hackernoon with the hashtag #bitcoin. Running for six months starting from May 22, 2024, the contest is divided into three two-month periods. At the end of each period, the most valuable research will be awarded, with five prizes ranging from $650 to $2,000.

Notably, Rootstock, despite being a separate network, does not have its own token like Optimism, Arbitrum, or Starknet. The team currently has no plans to launch a token in the near future. However, this stance might change as Rootstock has been rapidly losing its leadership in Total Value Locked (TVL) due to competitors like Merlin Chain and Bitlayer. Launching a native token could be an effective means of attracting a broader audience, addressing Rootstock's most significant challenge—user acquisition. Therefore, I will be closely monitoring the project for potential developments in this area.

8. Results

- The project was one of the first to develop a sidechain on the Bitcoin network back in 2015, introducing new technologies like Powpeg and Merged Mining.

- The Rootstock network hosts a comprehensive ecosystem of services known as RIF OS, which includes Account Abstraction, domain services, decentralized identification (DID), and decentralized storage services.

- In the future, RIF OS plans to enable the deployment of Layer-3 networks through RIF Rollups and introduce a separate non-custodial wallet, RIF Wallet.

- Since last year, the team has been actively researching and developing BitVM technology. This effort resulted in the publication of a new technological concept called BitVMX, which will allow the use of smart contracts instead of relying on a federated network.

- The Rootstock network boasts high security, achieving 43% of Bitcoin's security level, with nearly half of Bitcoin miners, including major pools like AntPool, F2Pool, and Luxor, helping to create network blocks.

- Rootstock suffers from very low user activity, with only a few hundred active addresses daily.

- While developers are actively building on the network, they often abandon their projects or migrate to other networks due to the small user base.

- To address this, the team has recently launched various incentive programs, including a substantial grant program and an ambassador program, aimed at boosting activity on the network.

- Rootstock employs over a hundred people and maintains strong financial stability, bolstered by a successful ICO in 2018.

- However, the RIF token, associated with the RIF OS ecosystem, lacks organic consumer demand related to Rootstock's network activity. The token's utility is concentrated on RIF OS rather than Rootstock.

- To attract users, a potential solution could be to launch incentive or airdrop/points programs for Rootstock Network.

- Currently, RIF's market capitalization is $160 million, with all tokens available in the market. The disconnect between Rootstock network and the RIF token leads to a valuation gap. This explains why the RIF token's market capitalization is significantly lower than that of $STX, despite both having comparable TVL and project ecosystems.

Research prepared by BitStaxi